IMF World Economic Outlook figures April 2022

The International Monetary Fund has released the April 2022 World Economic Outlook. Unsurprisingly, the ongoing Ukraine conflict is front and centre. Let me quote:

War slows recovery

The war in Ukraine has triggered a costly humanitarian crisis that demands a peaceful resolution. At the same time, economic damage from the conflict will contribute to a significant slowdown in global growth in 2022 and add to inflation. Fuel and food prices have increased rapidly, hitting vulnerable populations in low-income countries hardest.

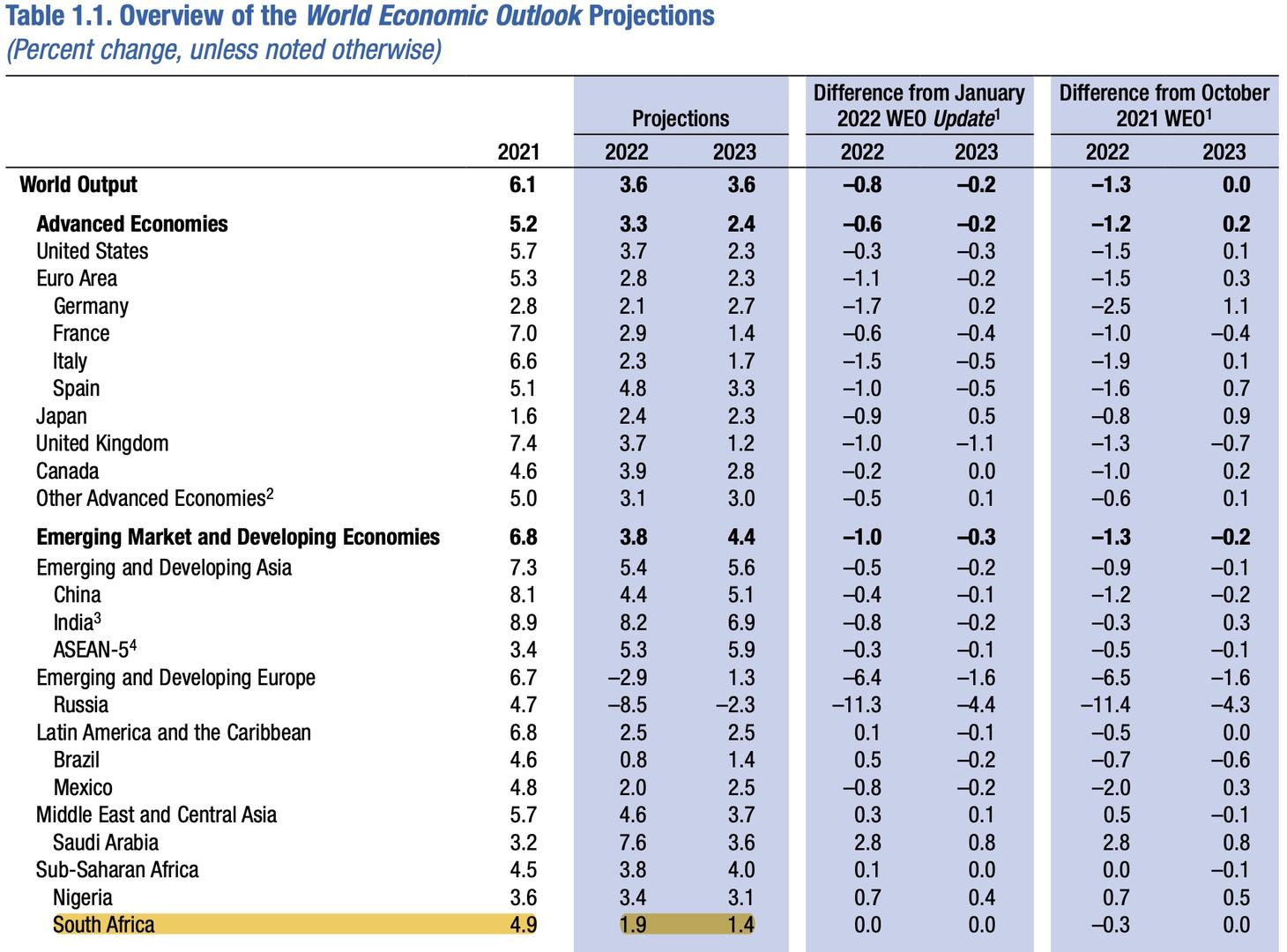

Global growth is projected to slow from an estimated 6.1 percent in 2021 to 3.6 percent in 2022 and 2023. This is 0.8 and 0.2 percentage points lower for 2022 and 2023 than projected in January.

Beyond 2023, global growth is forecast to decline to about 3.3 percent over the medium term. War-induced commodity price increases and broadening price pressures have led to 2022 inflation projections of 5.7 percent in advanced economies and 8.7 percent in emerging market and developing economies—1.8 and 2.8 percentage points higher than projected last January. Multilateral efforts to respond to the humanitarian crisis, prevent further economic fragmentation, maintain global liquidity, manage debt distress, tackle climate change, and end the pandemic are essential.

Overall global growth will drop from 6,1% in 2021 to 3,6% in 2022 and remain at that level in 2023. Of course, some do far better or worse than others.

Broadly speaking, almost every major economy gets a bit of a snot klap, to use an appropriate South African expression — drops in the region of 4 percentage points appear to be the norm. Japan and Saudi Arabia are exceptions. For the Saudis, growth is expected to jump from 3,2% to 7,6%.

India looks to be the world leader in the year ahead, with projected growth of 8,2%. Russia’s economy is projected to shrink by 8,5%.

In our part of the world, Sub-Saharan Africa, Nigeria declines negligibly from 3,6% to 3,4%.

South Africa is in snot klap territory: our growth will drop from 4,9% in 2021 to 1,9% in 2022, and decline further in 2023 to 1,4%.

If you're reading this throwing up your hands in horror, you should know I think these figures are BS.

I think the situation is actually going to be a lot worse.

Why? Well, the devil is in the detail, and the detail here is that these projections are based on some underlying assumptions:

- It assumes that the conflict remains confined to Ukraine

- It assumes further sanctions on Russia exempt the energy sector

- It assumes the Covid-19 pandemic’s health and economic impacts decline over the course of 2022.

My responses to each of these:

- If Sweden and Finland join NATO, expect the conflict to spread there.

If any of Ukraine’s neighbours are used as trans-shipment points for arms, expect Russia to attack there too.

Expect new conflicts near the South China Sea between China and the US around Taiwan and the Solomon Islands.

Expect further sabre rattling between North Korea and South Korea.

Expect a resurgent Mexico to be extending a middle finger to the United States.

Expect new clashes in Afghanistan because there's a new government in Pakistan. - The US is not going to allow Russian gas to continue to flow and will tighten sanctions on the energy sector. The only thing that will keep the flow of Russian gas going is regime changes or changes of heart in the major EU countries.

- China’s unsuccessful battle for zero-covid in Shanghai and Hong Kong is already pointing to severe impact on the global economy.

A final thought around South Africa’s figures: The secret to prosperity for any nation is for economic growth to be higher than population growth. Our population growth rate is around 1,2%. We have almost no wriggle-room.

Buckle up, we have a rough ride ahead.